Regov Technologies World-leading Web3 Identity Issuance & Authentication Management

- RM 2,434,800121% of the Min.Target (RM 2,004,750)

- 47Investors

- RM 300,000Largest Investment

- 13 Mar 2024Cooling Off Period End Date

This campaign was successfully funded on 7 Mar 2024.

- Equity - RCPS

- ~ up to 8.23%

- RM 55,801,842

- RM 2,004,750

- RM 5,004,450

- -

- Regov Technologies Sdn Bhd

- C-7-01, Capital 3, Oasis Square, No. 2, Jalan PJU 1A/7A, Ara Damansara

- 1246645K

- The World's-leading Web3 Identity Issuance & Authentication Management

Summary

Regov Technologies Sdn Bhd (Regov) was founded in 2018 and has since evolved into a thriving Malaysian technology company, achieving post-revenue and profit status. Regov is dedicated to revolutionizing the financial services industry and e-government through innovative solutions that foster hyperconnectivity in the digital realm. The company has developed a suite of key solutions and products, each with a distinct focus:

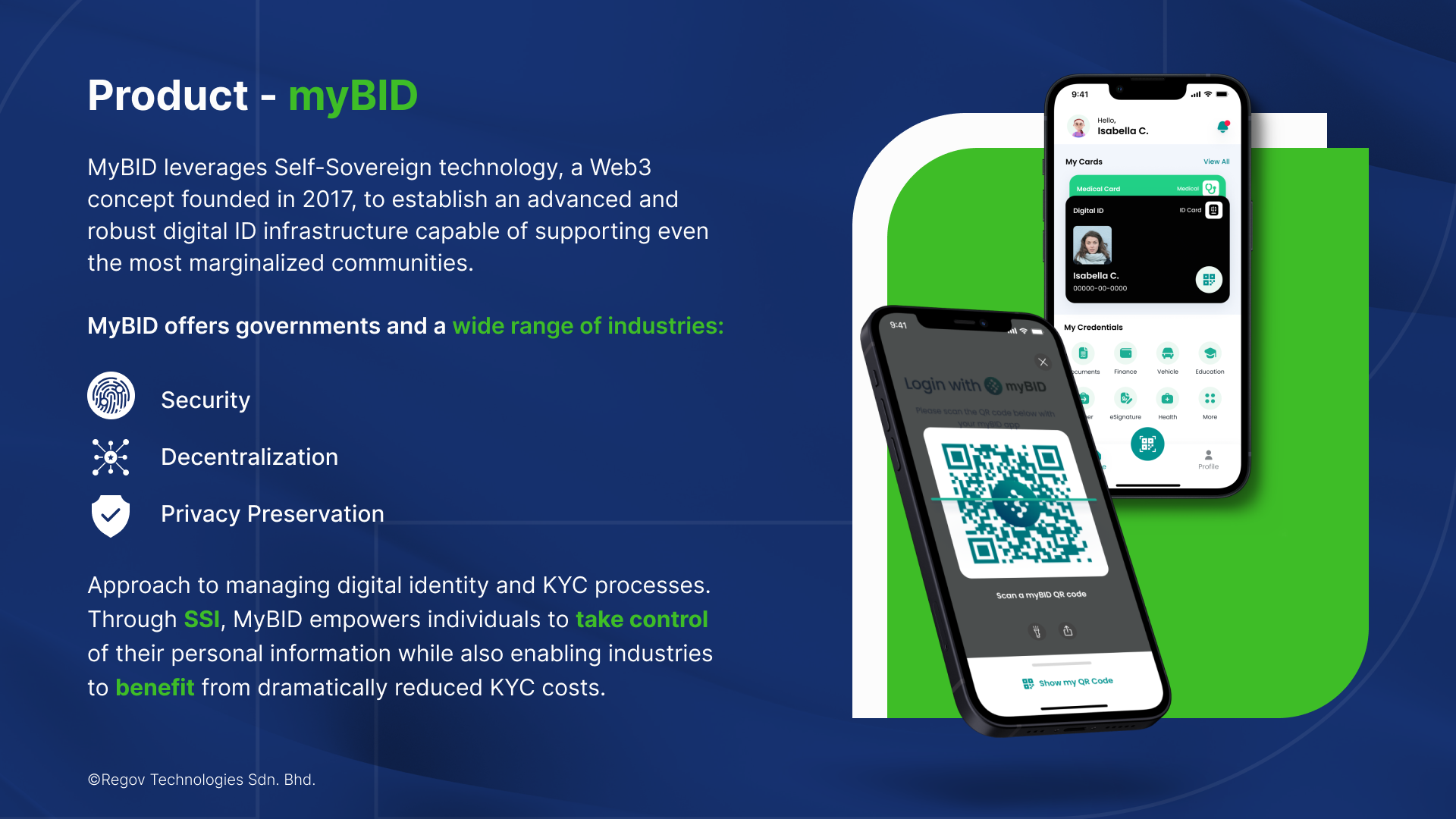

Regov's accomplished team comprises seasoned professionals with deep expertise in blockchain and AI technologies. They are at the forefront of developing these innovative solutions, tailored specifically for the financial services sector and government entities. These solutions offer secure, decentralized, and privacy-focused approaches to managing digital identity and Know Your Customer (KYC) processes, ultimately empowering individuals and organizations to regain control over their personal information.

With a dedicated team of over 50 experts based in Malaysia, Regov benefits from a diverse talent pool with more than 130 years of combined experience in leadership roles within the financial services and deep tech sectors. This skilled team drives innovation and delivers transformative solutions to the financial industry.

Regov is headquartered in Petaling Jaya, Selangor, Malaysia, and serves a global clientele, including the United States, Switzerland, Australia, and Malaysia. Leveraging one of Malaysia's largest in-house AI and blockchain teams, Regov consistently delivers top-notch services to financial institutions and Fortune Global 200 companies.

Problem

Regov Technologies is fundamentally driven by problem-solving. At the core of its mission, the company identifies specific challenges within the financial services and e-government sectors and leverages emerging technologies to provide innovative solutions. Regov's four products are meticulously designed to address distinct problems, ensuring they are not only commercially viable but possess unique selling points that set them apart in the market.

Let's begin by examining myBID:

Next, let's explore RICHA:

Let's look at OMNI.iAM:

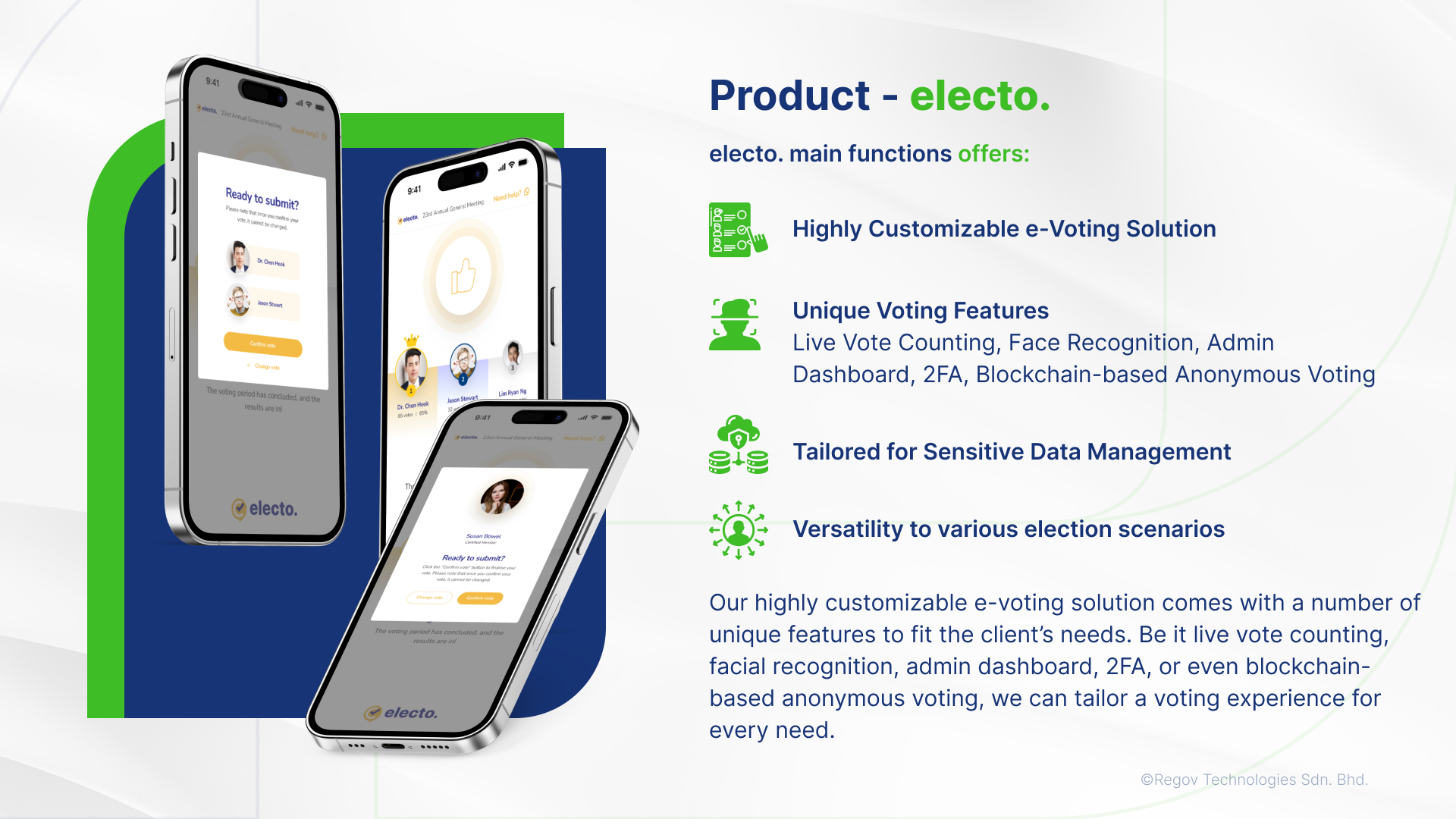

Now, let's take a closer look at Electo:

Solution

Regov Technologies is at the forefront of innovation with its four groundbreaking solutions. With myBID, we empower nations to provide secure web3 digital identities, giving citizens control over their personal information through Self-Sovereign Identity (SSI). Electo revolutionizes voting and polling by ensuring transparency and security through blockchain technology. OMNI.IAM simplifies financial services operations with tailored ERP solutions and robo-advisory tools. Lastly, RICHA uses AI and big data to transform customer service with advanced voice conversations. Regov Technologies' solutions are reshaping digital identity, governance, financial services, and customer support, leveraging cutting-edge technology to provide practical and secure solutions for today's challenges.

Product

Regov Technologies leverages its expertise to seamlessly integrate various solutions into comprehensive products, prioritizing an exceptional customer experience and seamless solutions for our clientele. With a focus on delivering robust features supported by best-in-class technology, Regov positions itself as a leader in each product category. Now, let's dive into our key products:

Traction

Building upon an impressive financial track record, Regov is poised for a solid financial year, with 70% of next year’s revenue coming from existing customers. As an already profitable tech startup, Regov represents a unique outlier in an industry where companies typically struggle to profit.

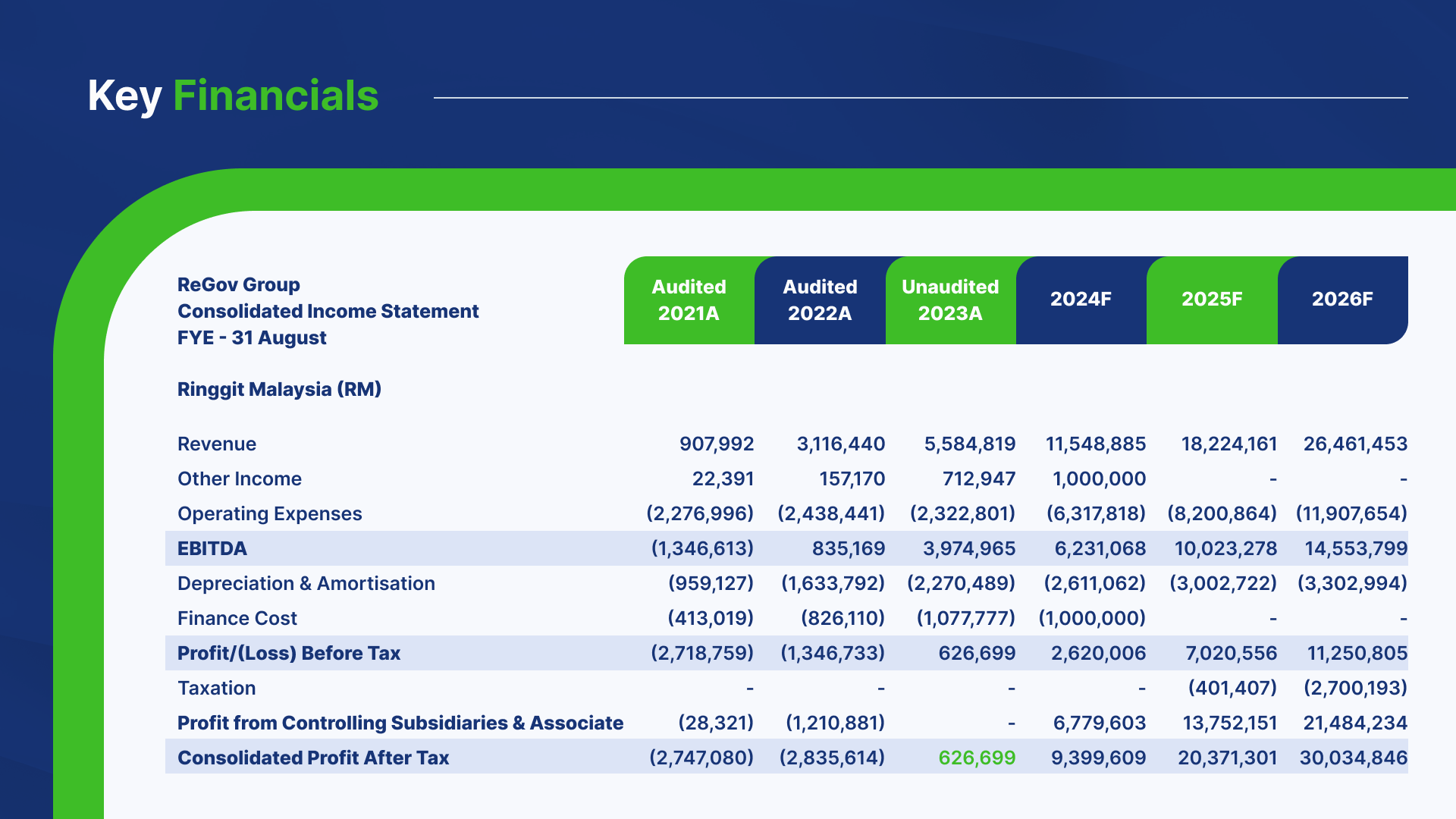

Since FYE2021, the company has witnessed remarkable revenue growth: 252% for FYE2022 and an unaudited growth rate of 92% for FYE2023. Projections for FYE2024 suggest a 74% revenue increase, with 79% derived from existing clients. Notably, the unaudited FYE2023 showcased the first PAT at RM626,699. With the introduction of Nauru SSI and related integrations, the Group PAT is anticipated to rise to RM9.4 million for FYE2024, RM20 million for FYE2025, and RM30 million by FYE2026.

Customers

Regov’s products are intentionally designed to serve a wide range of industries.

Business Model

Market

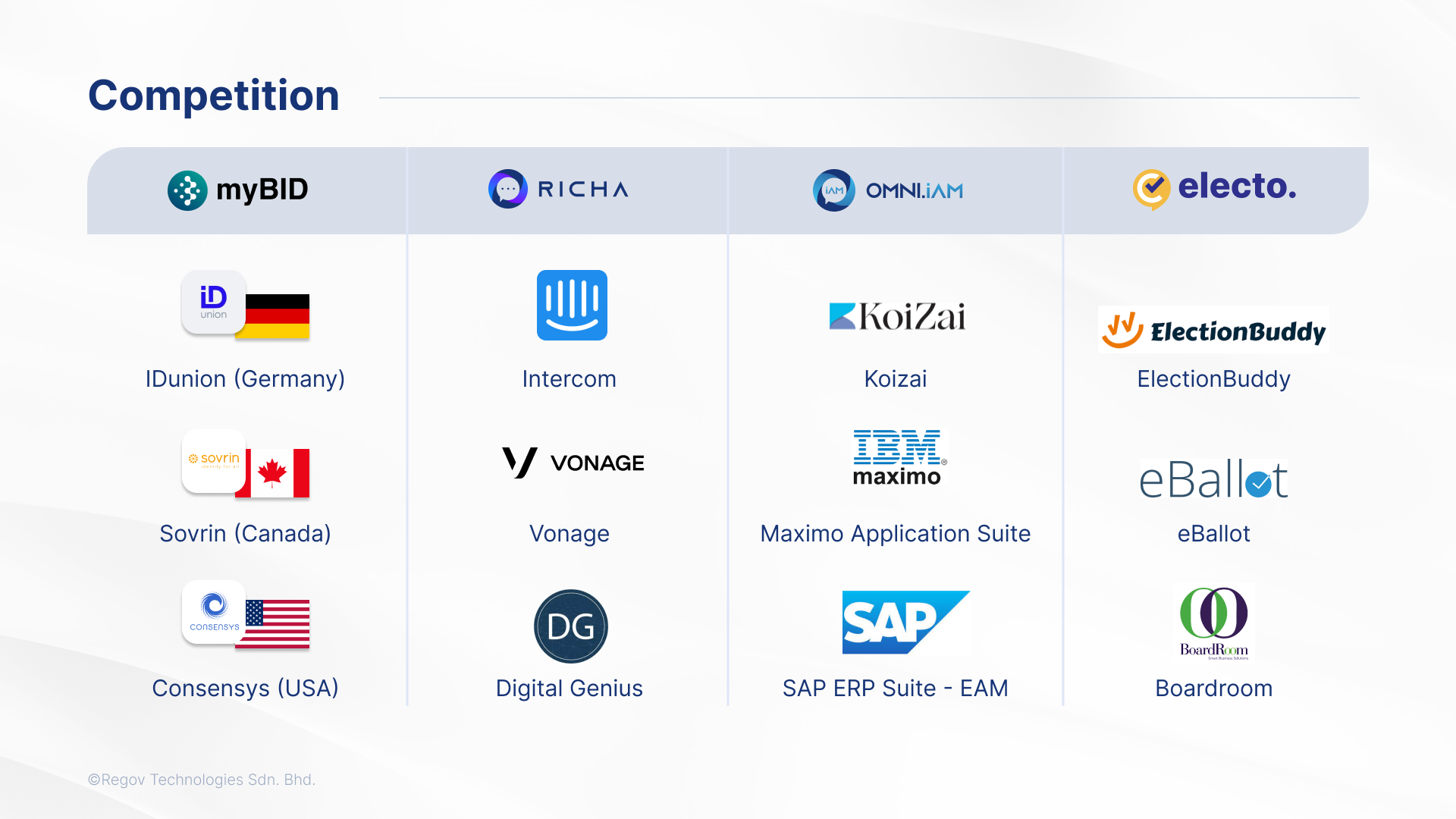

Each of Regov’s solutions employs emerging and secure technologies, giving us a unique edge against potential competitors. Our products also have USPs that cater to specific issues that the industry currently does not address, ensuring that each solution is created with an issue in mind.

Competition

Presented below are our competitors, each excelling in their respective industries and offering unique product types. In navigating this landscape, we aim to acknowledge our rivals and strategically position ourselves as industry leaders. As we explore the strengths and innovations of our counterparts, we find inspiration and motivation to elevate our offerings, fostering a dynamic environment of healthy competition and continual improvement.

Funding

Research and Development (R&D) - RM 1,250,000

The Company plans to invest RM 1,250,000 in Research and Development initiatives to develop cutting-edge technologies in Web3 proxy voting and Generative AI Trainer for Insurers. These technologies represent the forefront of innovation and are pivotal in ensuring the Company's long-term relevance and leadership in the rapidly evolving technology landscape. By investing in R&D, RegGov aims to enhance its product offerings, improve operational efficiency, and stay ahead of market demands.

Marketing - RM 250,000

An allocation of RM 250,000 will be dedicated to marketing activities. This fund will be utilized to enhance the Company's brand presence, expand market reach, and launch targeted marketing campaigns. The marketing initiatives will focus on increasing awareness about the Company's products and services, building strong customer relationships, and driving sales growth. A robust marketing strategy is essential to capturing new market segments and consolidating the Company's position in existing markets.

Working capital - RM 1,000,000

RM 1,000,000 will be allocated towards bolstering the Company's working capital. Adequate working capital is crucial for day-to-day operations, including procurement, production, and distribution activities. This fund will provide the Company with the necessary financial flexibility to manage operational expenses, seize business opportunities promptly, and respond to market fluctuations effectively. A stable working capital base ensures smooth business operations, timely supplier payments, and sustained growth.

Advance to a Subsidiary, RGX Capital - RM2,500,000

Of the RM2.5 million advanced from the holding company, RM1.5 million is earmarked for the development and rollout of myBID in the Republic of Nauru. RM500,000 will be channeled to the Web 3 Innovation Launchpad (W3IL), bolstering the expansion of the myBID ecosystem, and another RM500,000 is allocated for fees associated with the Digital Exchange listing.

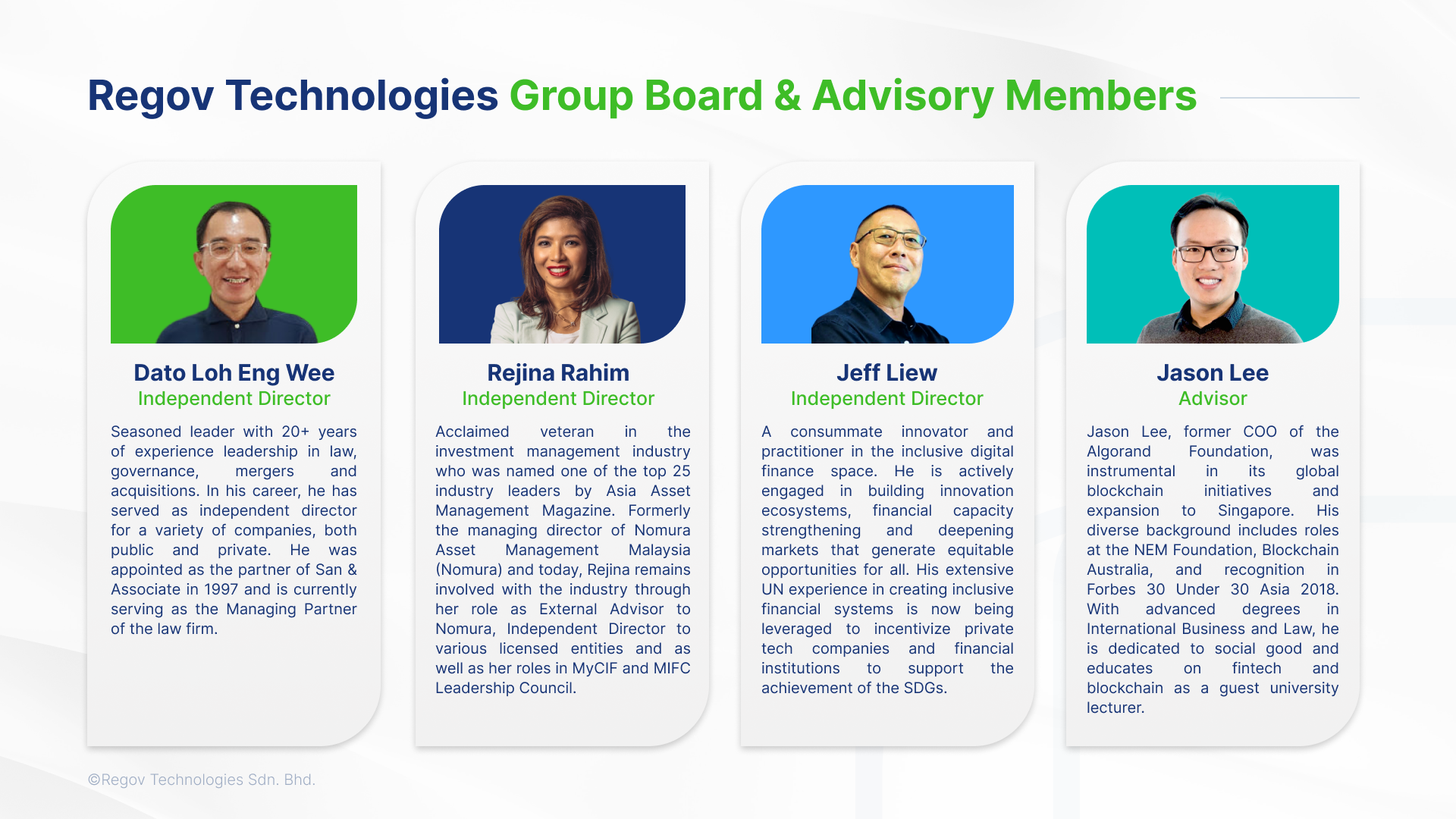

Team

Group Board and Advisory Members

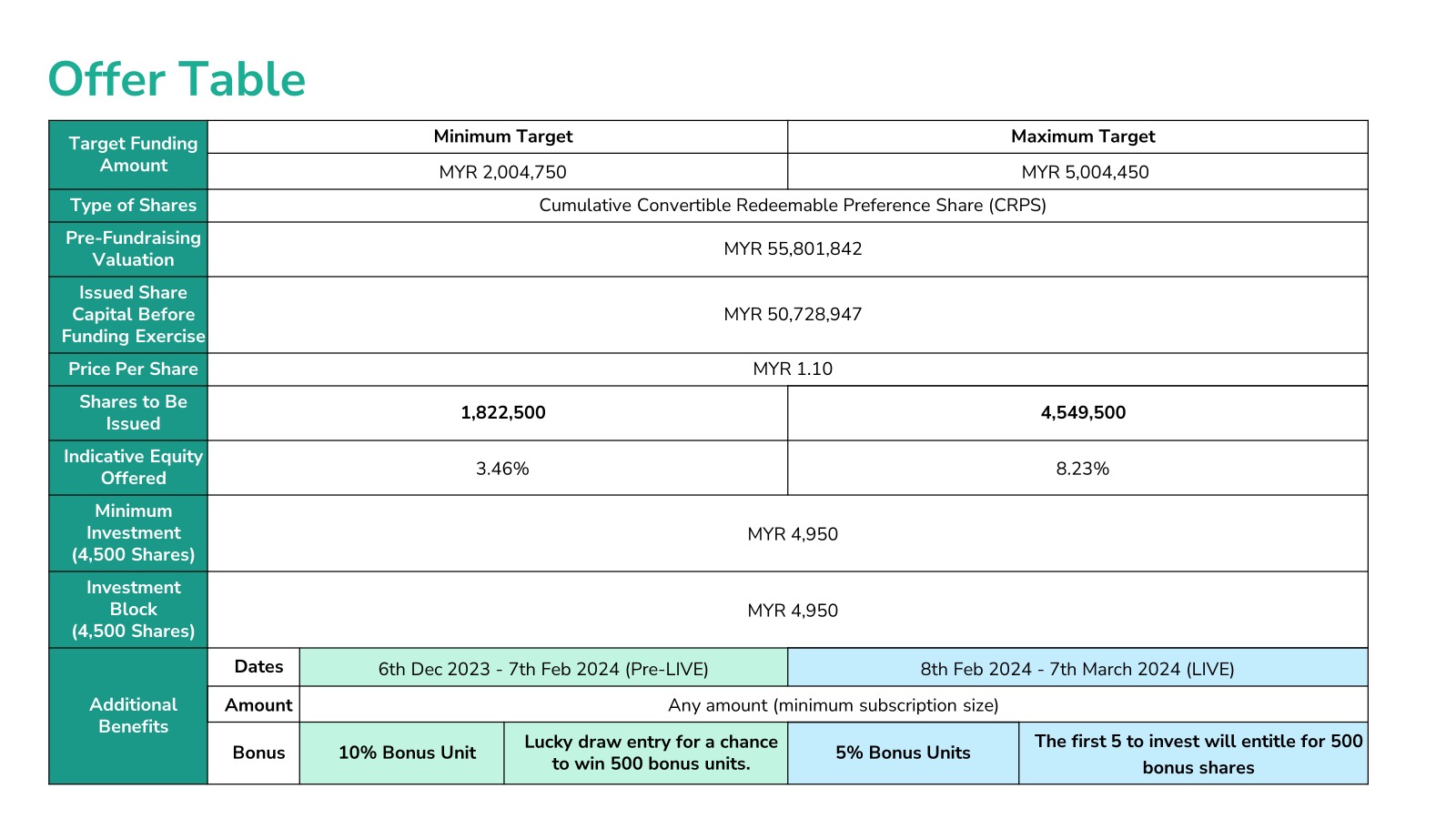

Investment Terms

Disclosure

- pitchIN and its officers and staff may also be investing in this campaign

- Under ECF Guidelines, valuation is determined and set by the Issuer. Investors are advised to carefully peruse all investment offers and documents before making investment decisions.

- Equity - RCPS

- ~ up to 8.23%

- RM 55,801,842

- RM 2,004,750

- RM 5,004,450

- -

- Regov Technologies Sdn Bhd

- C-7-01, Capital 3, Oasis Square, No. 2, Jalan PJU 1A/7A, Ara Damansara

- 1246645K